Agustín Etchebarne

Economista especializado en Desarrollo Económico, Marketing Estratégico y Mercados Internacionales. Profesor en la Universidad de Belgrano. Miembro de la Red Liberal de América Latina (RELIAL) y Miembro del Instituto de Ética y Economía Política de la Academia Nacional de Ciencias Morales y Políticas.

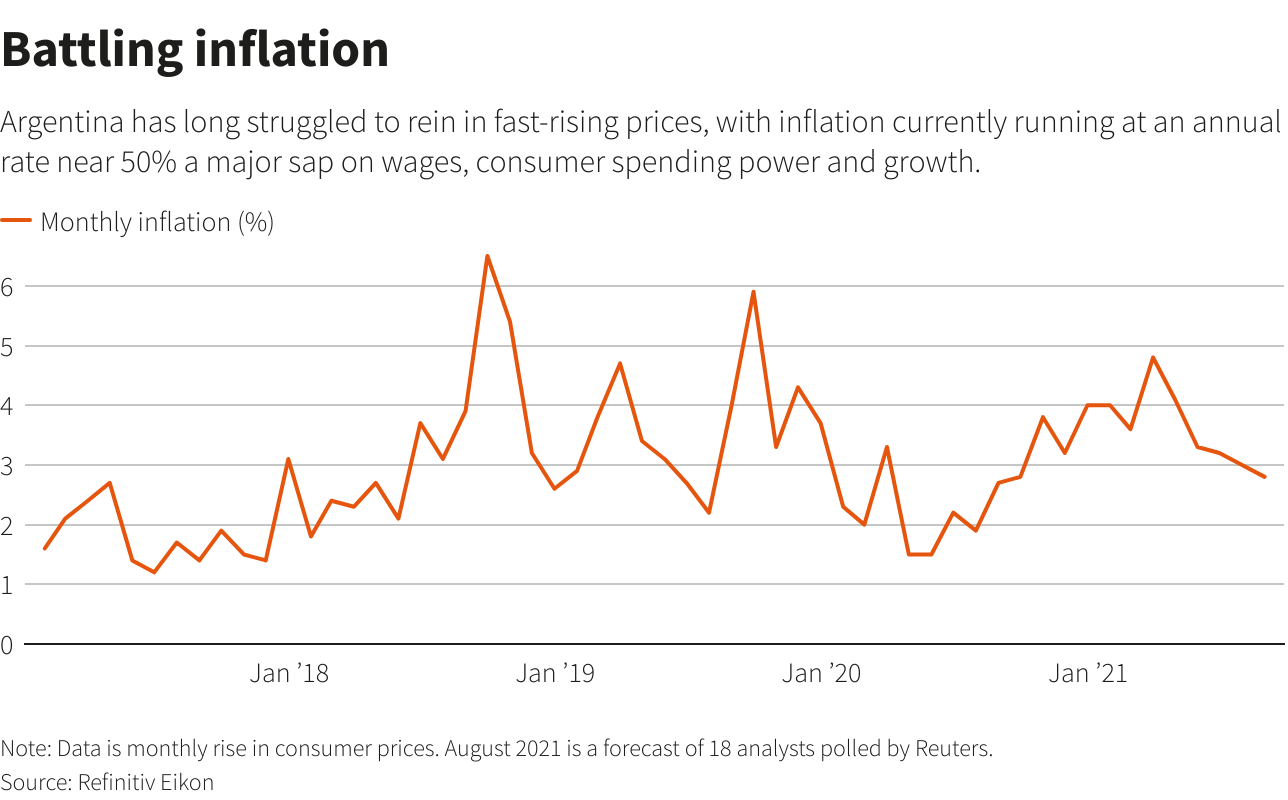

(Reuters) – Argentina’s inflation rate spiked back up to a higher-than-expected 3.5% in September after months of declines, heaping pressure on the Peronist government as it looks to keep prices down ahead of key midterm elections in November.

The monthly rise of the South American country’s consumer price index was above a median analyst forecast of 2.9% and well above 2.5% a month earlier. The 12-month rate was clocked at 52.5%, while inflation in the first nine months reached 37%.

Argentina has been battling runaway inflation for years, which saps savings, incomes and economic growth. Inflation is also heating up globally.

“This reverses the downward trend of recent months that was based on the exchange rate anchor and price controls, but which failed to change things,” said Isaias Marini, an economist at Econviews. “We expect inflation to accelerate in the coming months to end the year at over 51%.”

The government has taken steps to rein in prices. Earlier in the year it imposed a strict limit on exports of beef to bring down the domestic cost of meat, and this week struck a deal to freeze the price of some food and household goods for 90 days.

“The government made a great effort to try to reduce a little the CPI (consumer price index),” said Agustin Etchebarne of the Fundacion Libertad y Progreso. “Despite this, inflation is still close to 3% monthly.”

Etchebarne added a “devaluation and inflationary jump” was expected after the Nov. 14 legislative elections, where the government is expected to face heavy losses.

A central bank poll of analysts has forecast inflation for this year of around 48.2%, while the government has targeted inflation of 33% next year in its annual budget.

“The forecast of an annual inflation of 33% (for 2022) seems difficult to fulfill,” said Victor Beker of the Center for Studies of the New Economy from the University of Belgrano.

“A comprehensive anti-inflation plan for 2022 would be required, which would coordinate monetary, exchange and income policy measures, which, for now, is not in sight.”

A Reuters poll of analysts ahead of the official data release had forecast inflation in a range between 2.7% and 3.4%.Reporting by Walter Bianchi and Jorge Iorio; Additional reporting by Hernan Nessi; Editing by Adam Jourdan, Bernadette Baum and Rosalba O’Brien